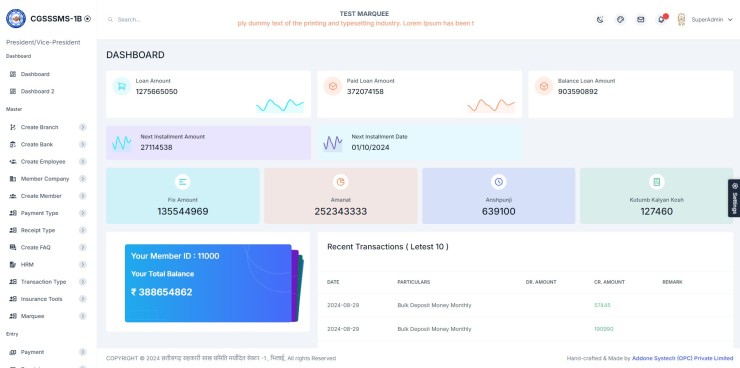

₹450,000.00

₹600,000.00

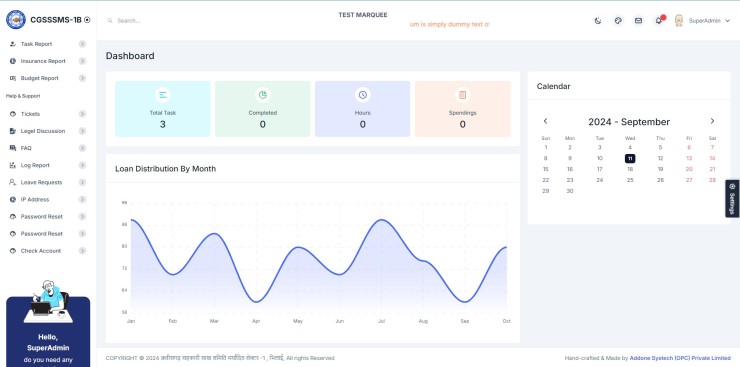

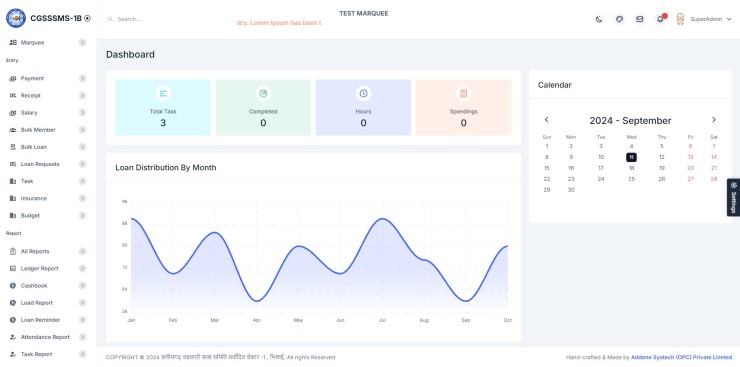

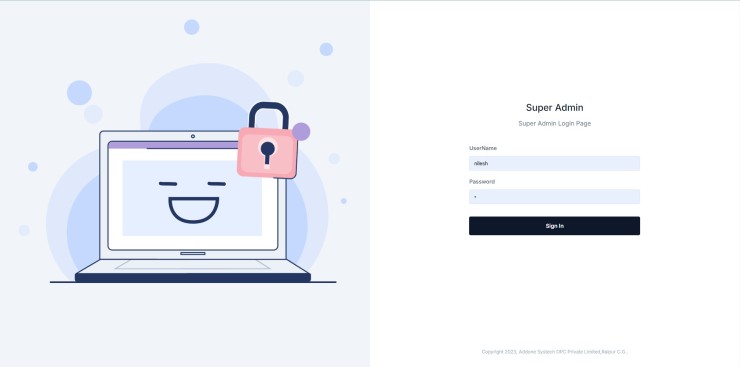

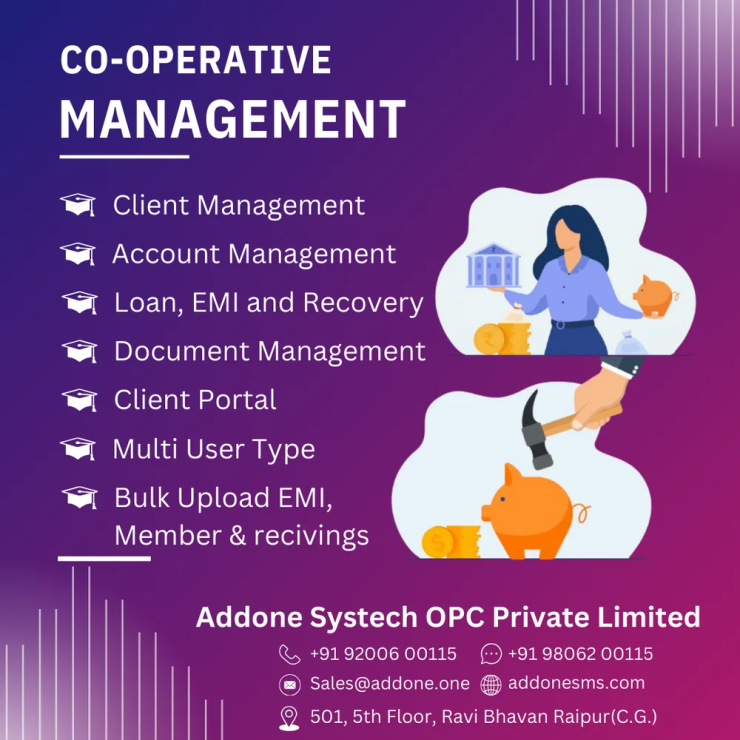

Co-operative Loan Management System is a web-based application designed to streamline and automate the entire loan lifecycle within a cooperative society.